Inventory is a company’s main asset used to generate sales revenue. The efficient handling of short-term financing entails selecting the appropriate financing mechanism and sizing the funds made accessible throughout. Managing short-term financing, like liquidity management, should concentrate on ensuring that the organization has enough liquidity to monetize short-term operations without taking huge risks. Managing accounts payable and making sure payments are made on time is a key component of working capital management. In some cases, non-payment could lead to mandatory liquidation of assets to pay off creditors. Late payments could result in penalties or fines, and can damage a company’s credit ratings too. Managing accounts payable is very important for maintaining effective working capital. Manage Account PayableĪccounts payable refers to money due and owing by a company to its vendors, shown as an obligation on a company’s balance sheet.

The collection ratio is often used to calculate the average time it takes for a company to receive payment after a credit sale is made.

If a company finds it difficult to receive cash from its debtors, it may suffer from cash flow problems. The amount becomes due when goods or services are delivered to a customer, but haven’t yet been paid for. Manage Account ReceivableĪccounts receivables are balances that debtors have to pay to the company. If a greater amount of a company’s assets are tied up in illiquid assets, it might find it difficult to maintain effective cash flows or pay its short-term debts. It is also significant because it affects a company’s financial health, which can contribute to its success or failure.

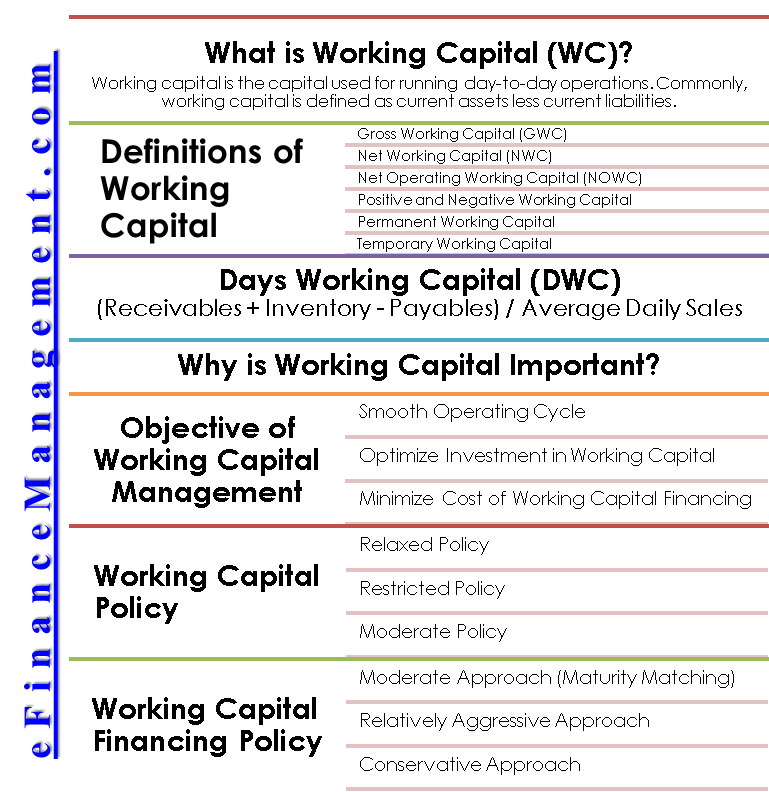

Proper liquidity management ensures that the organization has enough cash resources to address its regular business needs. Working capital management can be further divided into several key components: 1. Key Components of Working Capital Management Companies often conduct ratio analysis for working capital management. Short-term investments and available inventory are also classified under current assets.Ĭurrent liabilities are obligations that the company has to pay off within the next 12 months, including accounts payables and any debt payments that become due in this period. These are generally quite liquid, often including accounts receivables and cash-in-hand. Working Capital = Current Assets – Current LiabilitiesĬurrent assets are all assets that a company can convert into cash within the next year (12 months). The formula for calculating working capital is as follows: Working capital management allows organizations to maintain cash flows and lets them meet short-term targets, while also factoring in unexpected costs and unlocking cash that’s often tied up on the balance sheet. Working capital management is defined as the process through which a company plans for utilizing its current assets and liabilities in the best possible manner to ensure operational effectiveness. It helps companies make routine payments and ensure the smooth performance of business operations. Working capital is the capital that a business uses to run and manage its regular operations.

0 kommentar(er)

0 kommentar(er)